DAC Course Detail – Fees, Duration, Syllabus, Admission, top 1 Best Institutes, and Jobs

Business mein transactions ki entry sirf manual books tak limited nahi rahi. Ab har business apne records digitally maintain karta hai, aur iske liye different accounting software ka use hota hai. Accounting field me DAC (Diploma in Accounting Concepts) ek popular professional course hai, jo aapko practical accounting skills aur software knowledge provide karta hai, jisse aap job-ready ban sakte ho. Vedantsri mein DAC course ko specially is tarah design kiya gaya hai, jisse students ko professional accounting skills mil sakein.

| Overview | Description |

|---|---|

| What is DAC? | DAC ek professional diploma course hai jo students ko accounting ke basic se lekar advanced concepts tak ki clear aur practical knowledge deta hai. |

| DAC Full form | Diploma in Accounting Concepts (DAC) |

| Course Duration | 6 Months – 12 Months |

| Eligibility | 10th / 12th Pass (Commerce preferred but not mandatory) |

| DAC Fees | ₹5,000 – ₹6,500 |

| DAC Fees at Vedantsri | ₹3,900/- only |

| Software you learn | Tally Prime, Tally with GST, Excel Accounting |

| Key Subjects | Accounting Basics, GST, TDS, Inventory, P&L, Balance Sheet |

| Job Roles After DAC | Accounts Executive, Junior Accountant, Billing Executive, GST Assistant |

| Starting Salary | ₹8,000 – ₹20,000 per Month |

Is article mein DAC course se related Fees, Duration, Syllabus, Scope aur Job opportunities ko detail mein explain kiya gya hain. Agar aap accounting field mein best course ki talaash mein ho, ye article aapke liye complete guide ka kaam karega.

What is DAC Course?

Diploma in Accounting Concepts (DAC) ek professional accounting diploma course hai jo students ko accounting ki basic se advance k saath practical knowledge bhi sikhata hai. Yeh course un logon k liye hai jo accounts, taxation, aur accounting software se related kaam seekhna chahte hain.

Is course me basic se advanced accounting, journal entry, ledger, final accounts, GST, aur TDS padhaya jata hai, aur saath hi Tally Prime aur Excel Accounting jaise accounting software ka practical training diya jata hai, jisse aap office accountant, billing executive, aur accounts assistant jaise roles ke liye job-ready ho jate hain.

Agar aap accounting ke aur professional options explore karna chahte ho, to aap Certificate in Accounting Concepts (CAC) course ke details bhi dekh sakte ho.

DAC Course Full Form

DAC ka full form — Diploma in Accounting Concepts.

Course Level: Diploma

Stream: Accounting / Commerce

Mode: Classroom / Offline (kuch institutes online class bhi support krte hain)

DAC course Duration

DAC course ki duration institute par depend karti hai, lekin generally ye course 6 months se 12 months tak complete hota hai.

Kuch institutes student k needs k according bhi apna duration adjust krti hain.

Agar aap communication skills, leadership quality, confidence building, aur professional behavior jaise important skills develop karna chahte ho toh DPD (Diploma in Personal Skill Development) Course ek achha option ho sakta hai.

DAC Fees

DAC course fees ka average fees ₹5000 – ₹6500/- tak hain. Par, VedantSri Computer Training Institute ka DAC course ka fees ₹3900/- hai, aur yaha apko fees ko installment mein payment krne ka option bhi milta hai.

DAC Syllabus

DAC syllabus ko is tarah se specially design kiya gaya hai ki students ko complete accounting knowledge mile. Isme theory ke saath-saath practical projects bhi include hain, jisse students ko real job-oriented aur professional working environment ka experience milta hai.

Syllabus Of DAC Course is

Software Training

- Tally Prime

- Tally Prime With GST

- Excel Accounting

Basics Of Accounting

- Introduction to Accounting

- Types of Accounting

- Types of Accounts

- Company Nature

Rules Of Accounting

- Golden Rule of Accounting

- Debit (Dr.) aur Credit (Cr.) ka concept

- Modern Rule (Accounting Equation)

Ledger/Voucher

- Ledger ka Introduction

- Types of Ledger Accounts

- Balancing of Ledger

- Voucher Meaning

- Types of Vouchers

- Preparation of Voucher

- Voucher Format & Components

- Supporting Documents

Billings

- Billing Introduction

- Types of Bills/Invoices

- Invoice Format

- Discount in Billing

- Purchase & Sales Billing

- Return Billing

- Manual Billing Practice

- Software Billing (Basic)

Transaction Entries

- Transaction ka Meaning

- Types of Transactions

- Journal Entry Rules

- Cash Transaction Entries

- Credit Transaction Entries

- Expense Entries

- Income Entries

- Capital & Drawings Entries

- Bank-Related Entries

- Purchase & Sales Return Entries

Accounting Voucher

- Accounting Voucher Introduction

- Types of Accounting Vouchers

- Payment Voucher Entries

- Receipt Voucher Entries

- Contra Voucher Entries

- Journal Voucher Entries

- GST in Accounting Vouchers (Basic)

Inventory Voucher

- Inventory ka Introduction

- Types of Inventory Vouchers

- Purchase Voucher

- Sales Voucher

- Purchase Return Voucher (Debit Note)

- Sales Return Voucher (Credit Note)

- Stock Item Creation

- Purchase Inventory Entry

- Sales Inventory Entry

- Return Vouchers

- Inventory Adjustment Voucher

- Stock Journal (transfer / adjustment)

- Physical Stock Voucher (stock shortage/excess)

- Rate & Quantity Management

- GST in Inventory Vouchers

- Inventory Reports

Taxation & Duties

- Taxation ka Introduction

- Types of Taxes (Direct Tax, Indirect Tax)

- GST (Goods and Services Tax)

- GST Registration (Overview)

- GST in Accounting

- GST in Billing

- GST Returns (Basic Knowledge)

- Other Duties & Taxes (TDS, Professional Tax, Customs Duty/Excise)

- Tally me Taxation Setup

Profit & Loss Accounts

- P&L Account Introduction

- Gross Profit and Net Profit

- Indirect Expenses

- Indirect Incomes

- Expense Classification

- Adjustment Entries

- Preparation of P&L Account

- Net Profit/Net Loss Calculation

- Transfer of P&L Balance

Balance Sheet

- Balance Sheet Introduction

- Accounting Equation

- Assets Classification

- Liabilities Classification

- Capital Account

- Adjustments in Balance Sheet

- Closing Stock Treatment

- Preparation of Balance Sheet

- Balance Sheet in Tally

Practical Projects of

- Ledger/Voucher

- Billings

- Transaction Entries

- Accounting Voucher

- Inventory Voucher

- Taxation & Duties

- PL Accounts

- Balance Sheet

Admission Process

Ye best hota hai ki aap jis institute ko choose kar rahe ho, uske exact admission rules pehle check kar lein.

Eligibility Criteria:

- Minimum Qualification: 10th / 12th pass (Commerce preferred but not mandatory)

- College student bhi is course ko kar sakte hain.

Admission Process in VedantSri Institutes:

- Application form fill karna hoga.

- Required documents submit karna hoga

- Form details verify karna hoga

- Fees pay karna hoga

- Start the classes

Agar aap accounting ke saath advanced computer aur management skills bhi seekhna chahte ho, to DCM (Diploma in Computer Management) course aapke liye ek perfect choice ho sakta hai. Ye course aapko multi-skill professional banane me help karta hai aur job opportunities ko kaafi boost karta hai.

Diploma in Accounting Concepts (DAC) Course Scope

Accounting field me scope hamesha strong rehta hai kyunki har business ko accounts aur taxation ki zarurat hoti hai. DAC course complete karne ke baad students private companies, CA firms, offices, shops aur startups me kaam kar sakte hain.

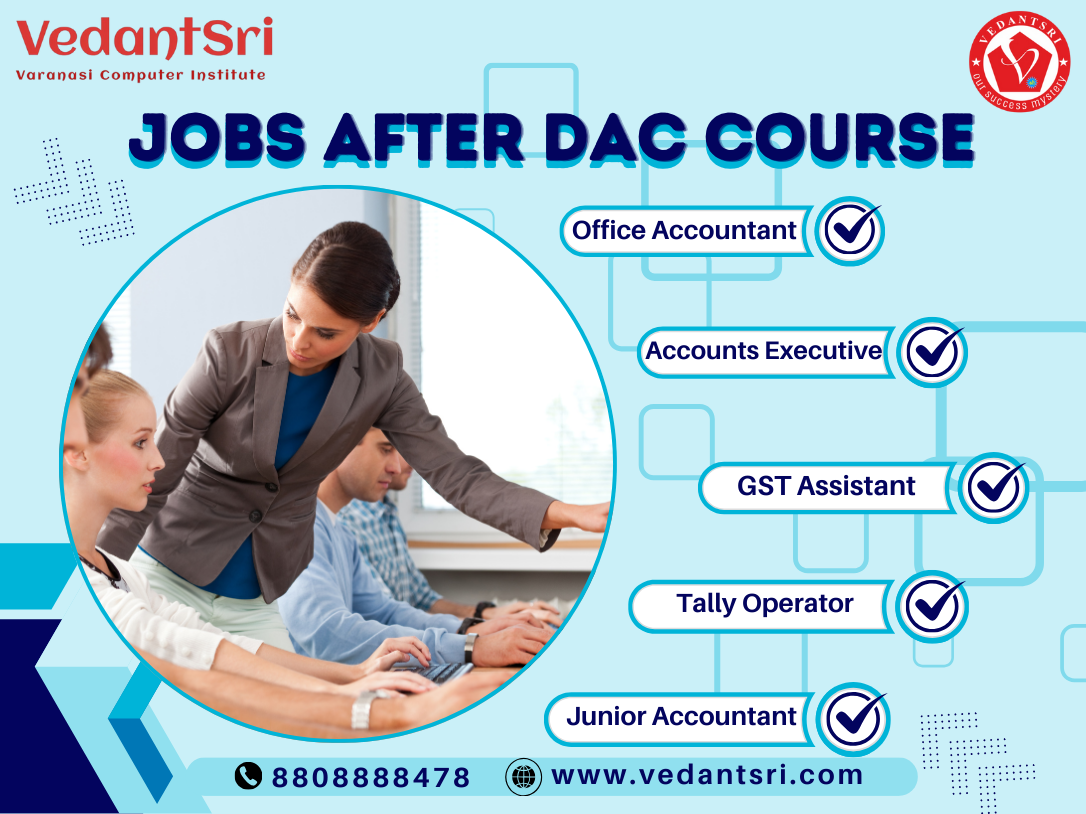

Jobs After Diploma in Accounting Concepts (DAC) Course

DAC course ke baad aap in job profiles ke liye apply kar sakte hain:

- Accounts Executive

- Junior Accountant

- Billing Executive

- Tally Operator

- GST Assistant

- Office Accountant

- Accounts Assistant

Starting Salary: ₹8,000 – ₹20,000 per month (experience aur skills ke according)

Latest jobs ke liye aap JobDo k portal par visit kar sakte ho.

Why Choose Diploma in Accounting Concepts?

- Job-oriented course hain.

- Accounting or Taxation ka practical knowledge milega.

- Fresher ke liye best career option hain.

Best Institutes for Diploma in Accounting Concepts

Varanasi me kai well-known institutes is course ko offer karte hain. Inme se ek popular aur trusted institute VedantSri Computer Training Institutes hai, jo apne experienced teachers, achhe computer labs aur well-structured course content ke liye jana jata hai. Yahan students ko theoretical ke saath-saath practical knowledge bhi di jati hai, jisse wo real-world working environment ke liye ready ho jate hain.

Agar aap accounting ke alawa IT field mein jana chahte ho, toh aap Diploma in Computer Engineering (DCE) course ko bhi explore kar sakte ho.

Highlights of VedantSri Computer Training Institutes:

- Affordable fees ke saath flexible batch timings

- Accounting & computer par practical-based training

- Experienced faculty se proper guidance

- Career-oriented curriculum jo job ke liye useful hai

Agar aap latest fee offers ke baare me jana chahte ho toh VedantSri k page par visit kr skte ho.

Conclusion

Agar aap accounting field me jaldhi career start karna chahte hain, to Diploma in Accounting Concepts (DAC) ek acha option hai. Ye course aapko practical accounting skills ke saath job-ready banata hai aur private sector me multiple opportunities open karta hai.

Agar aap apni foundation ko aur strong karna chahte ho, to aap Basic Computer Course (BCC) course ko bhi consider kar sakte ho, jo accounting ke saath computer skills ko aur better banata hai.

FAQs

What is the full form of DAC course?

DAC course ka full form Diploma in Accounting Concept hai. Ye ek professional accounting course hai.

What is a DAC job?

DAC job me students ko Accounts Executive, Junior Accountant, Billing Executive jaise accounting-related roles me kaam karne ke job opportunities milti hain.

How long does it take to get DAC certificate?

DAC certificate usually 6 se 12 months ke andar mil jata hai, jo institute ke syllabus aur training duration par depend karta hai.

What is the age limit for DAC course?

DAC course ke liye koi fixed age limit nahi hoti. Koi bhi student ya working professional, jisne basic education complete ki ho, is course ko join kar sakta hai.

What are DAC course fees?

DAC course ki fees duration, mode, aur practical training par depend karti hai aur institute ke hisaab se vary hoti hai. Vedantsri Institute students ko affordable fees ₹3900/- me DAC course provide karta hai, flexible payment options ke saath.